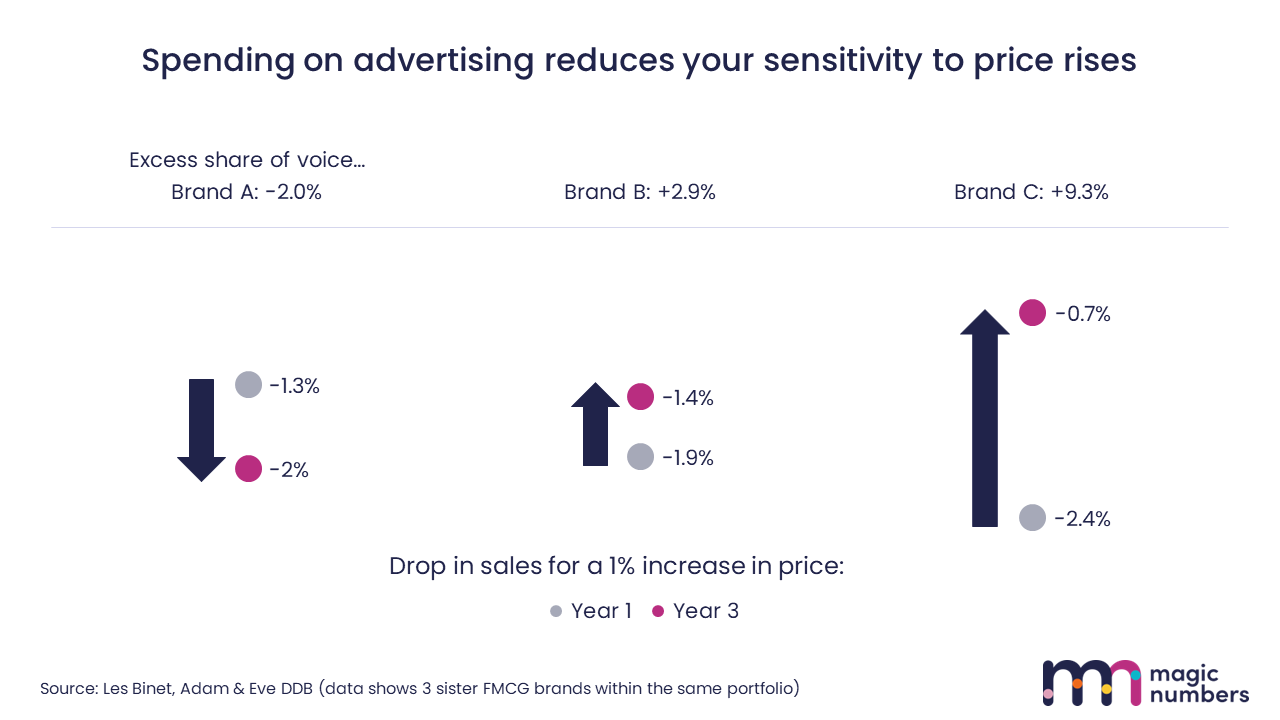

The chart shows that, over the 3 years in the study, brand C’s price elasticity improved to the point where price rises would be profitable, while brand A’s worsened to the extent that price rises would be a disaster.

Two case studies of modern brand building that led to price insensitivity

Two more detailed case studies come from our clients at Magic Numbers: Yorkshire Tea and Little Moons. Even though they have different strategies, both have built strong brands, and both have category beating price elasticities.

2023 Grand Effie winner Yorkshire Tea built their brand the traditional way, with a strong creative idea delivered in an entertaining way on TV. Like brand C in the case study above, they maintained positive excess share of voice over many years.

The result was that they not only grew to be the tea category leader, but throughout their growth they’ve maintained a premium price position.

And, when Yorkshire Tea were forced to increase prices in June 2022, the reduction in sales was modest. Econometrics showed that their price elasticity was 25% below what’s normal in FMCG.

Little Moons’ brand building story was quite different. Their strategy was to create a mochi ice cream product and brand that people wanted to spend time with.

This, combined with a bit of luck, brought a brand-building viral moment on TikTok, with platform native creators producing content. Little Moons then built on this momentum with successful advertising and a series of events and activations.

Even though the story was quite different, the result was the same. Little Moons have experienced very fast growth, while maintaining a price point above other ice cream. Their price elasticity is a full 35% below the FMCG category benchmark.

A warning, brand building isn’t the right choice for some categories right now

The advice from the above analysis seems pretty clear. If you’re going to need to put prices up, invest in your brand first.

But there is a proviso to it.

Inflation causes demand to drop in some categories more than others. And if you’re in one of those that’s worst affected, you might be wiser to wait.

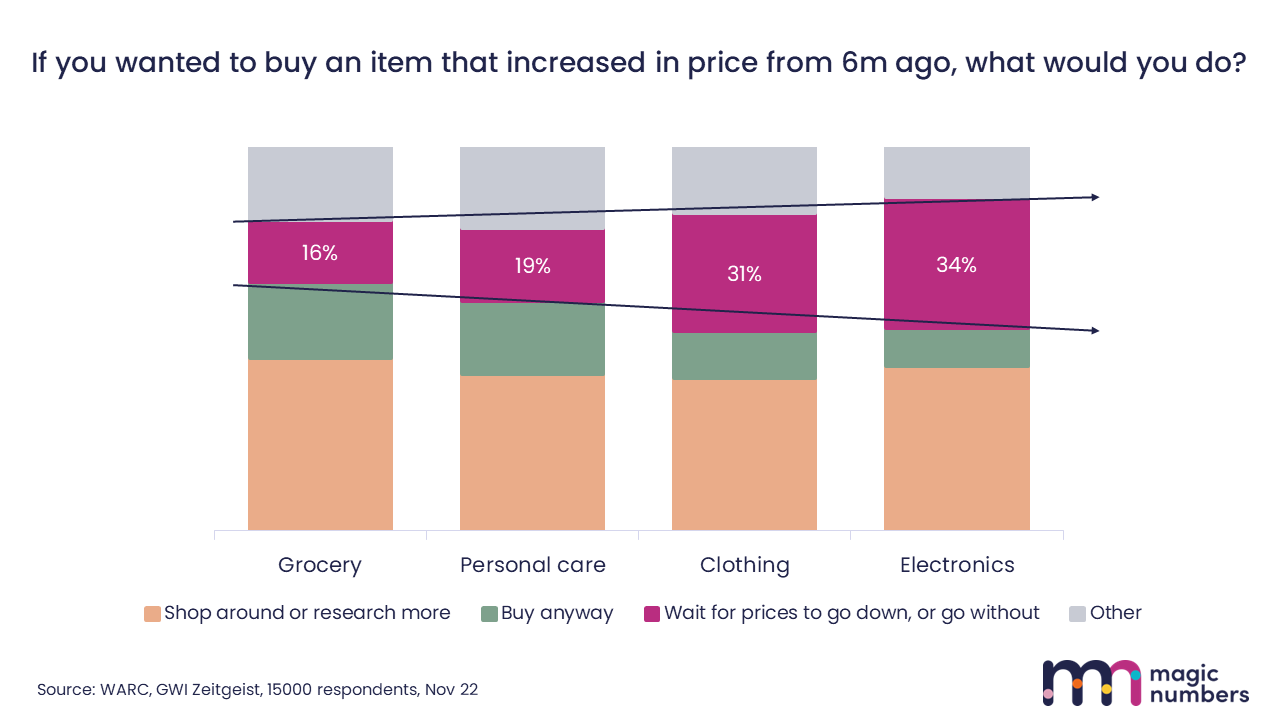

The chart below uses data from WARC’s recent trends survey, which asked 15,000 people what they would do if they wanted to buy an item that had increased in price from 6 months ago.

Categories are ordered from left to right based on how necessary the product is. And the proportion who would halt their purchase increases rapidly the more discretionary or non-essential the item is.